Cross River Bank Second Draw

Paycheck Protection Program PPP Application Closed. With an average loan size below 25000 we have supported the most vulnerable small businesses in our communities.

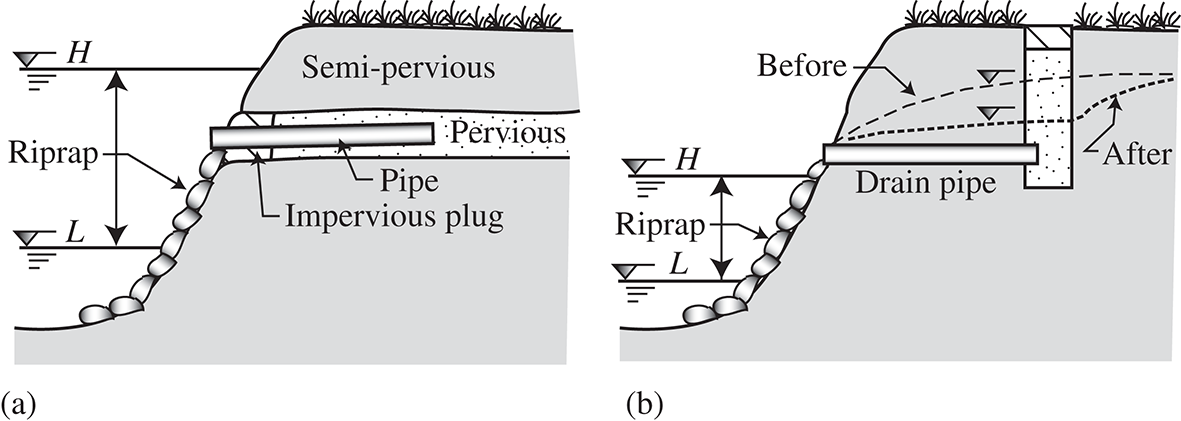

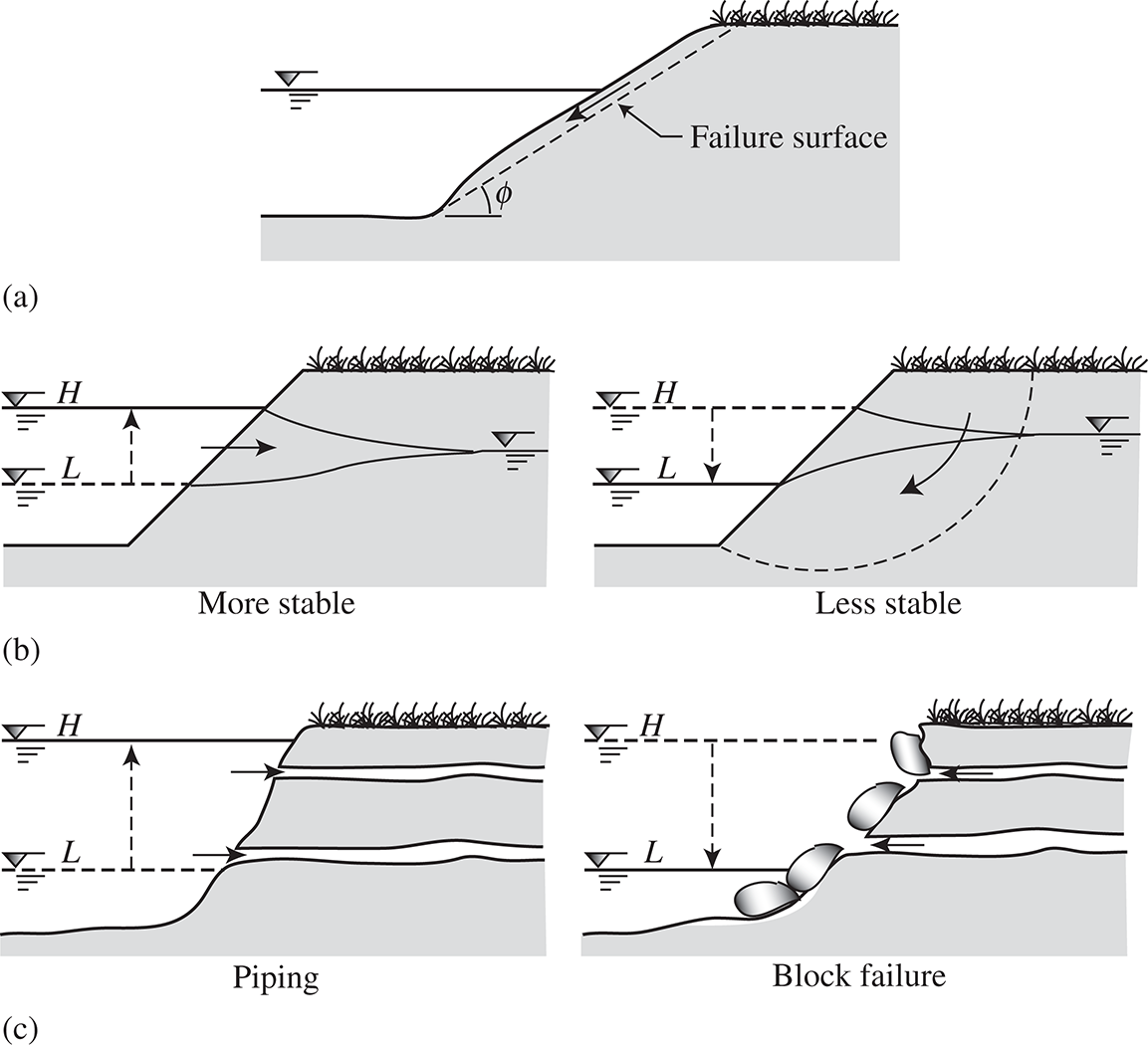

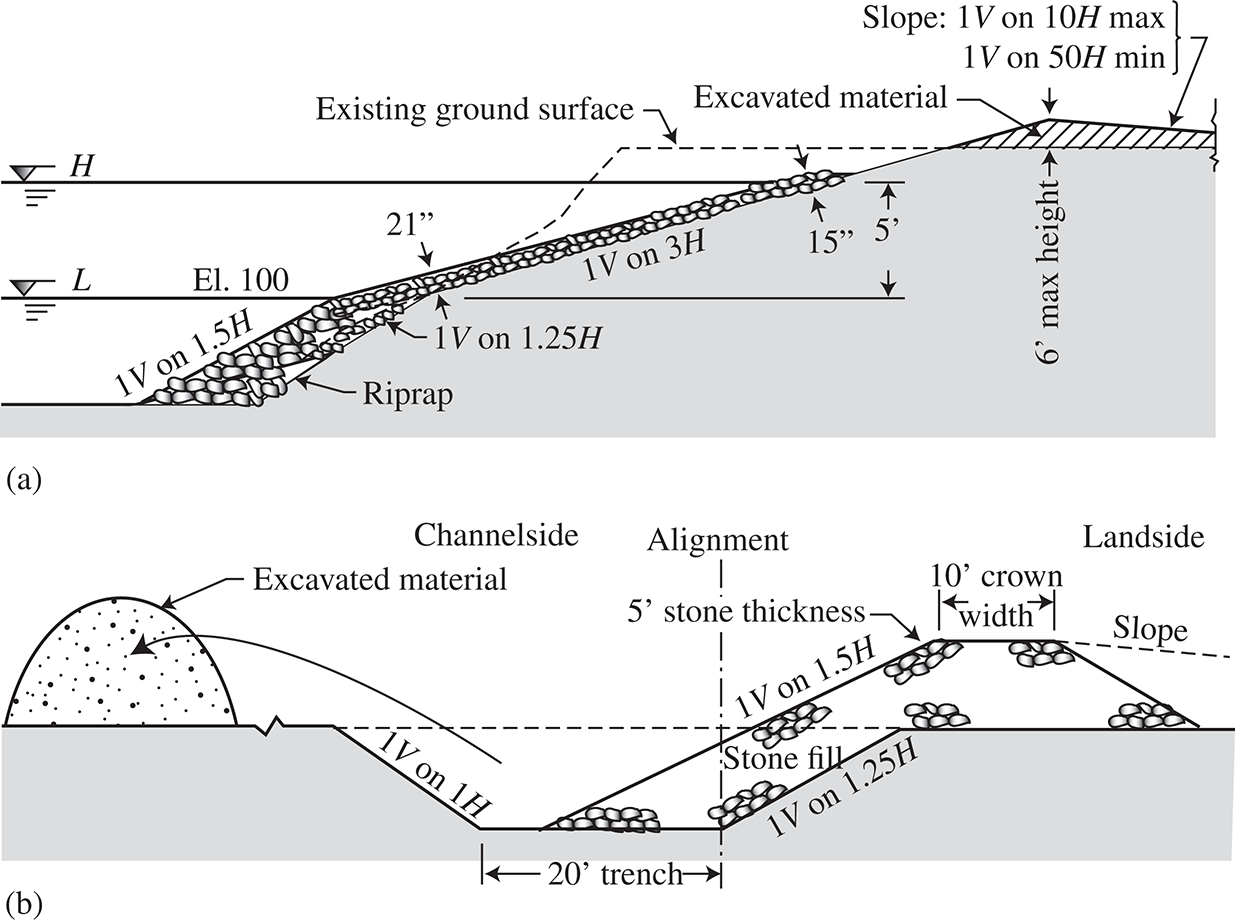

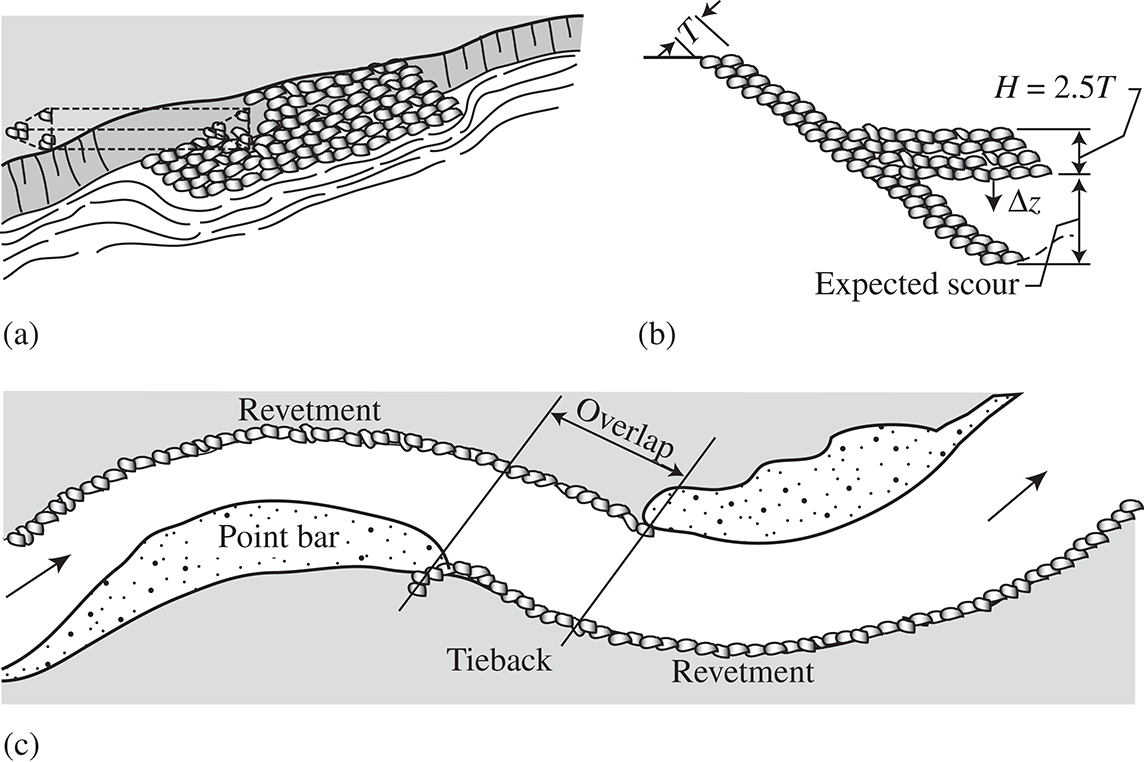

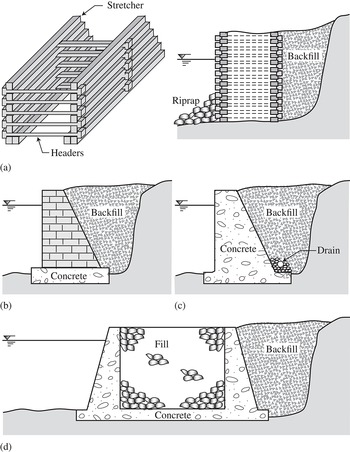

Riverbank Protection Chapter 9 River Mechanics

Second-Draw Requirements For second-draw PPP loans more than 150000 you must provide proof of 25 loss.

Cross river bank second draw. Bank of America is now accepting applications for both first and second draw PPP loans. With an average loan size below 25000 we have supported the most vulnerable small businesses in our communities. We will walk you through the full Paycheck Protection Pr.

Drivers license 2019. Unity aims to reach more small businesses including minority-owned businesses during the second-draw program by partnering with Fort Lee New Jersey-based Cross River Bank. Simple sole proprietor application no employees 4 docs needed.

Cross River combines the trust and reliability of a bank with the cutting-edge innovation of a technology company. Cross River Bank is proud to serve as one of the top PPP lenders in the country reaching more than 375000 businesses. Unitys partnership with Cross River offers small businesses the banking and.

Drivers license 2019. Harvest Small Business Finance. My loan amount was based on net income line 31 on my IRS Form 1040 Schedule C but the SBA changed it to gross income line 7 on Form 1040 Schedule C after my loan was approved.

Please follow the steps below to repay your loan. Lendio Lendo is not a lender but they partner with SBA-approved lenders to help businesses access PPP. Kapitus is a growth capital provider to small businesses and is partnering with a New Jersey financial institution Cross River Bank to underwrite the loans.

See my current status from their portal here. Visit our FAQ page. Total local PPP dollars loaned in 2020.

When you must substantiate that you had a 25 loss in gross receiptsgross income Gross Profit COGS between 2020 and 2019 you can do so by choosing one of the following comparison choices. Emergency relief for businesses disrupted by COVID-19. Second draw loan available Borrowers applying for a second draw loan may have no more than 300 employees and must show at least a 25 reduction in revenue in accordance with the requirements.

If you have any questions for them they can be reached at supportscratchfi or 1-844-727-2684. For Cross River Bank clients please reach out to their third-party servicing agent Scratch. You can apply now for first or second round funding.

Utilizing its streamlined technology and comprehensive lending platform Cross River originated nearly 200000 PPP loans during the initial round of the SBA Paycheck Protection Program saving close to 1 million jobs. Cross River Bank is accepting both first and second. Cross River Bank Application Process Walkthrough including document checklist and guides Choose the situation that best describes you or your business and follow the step-by-step guide.

Submitted application to Cross River Bank. Full year 2020 to full year 2019. Visit our FAQ page.

Visit our FAQ page. Our application is powered by Cross River Bank. PPP Application through Cross River Platform.

Independent contractor or self-employed with no employees. This video is for independent contractors gig workers and self-employed persons without employees. Sole-proprietorship or self-employed with employees.

Cross River Bank Paycheck Protection Program. Now Unity has partnered with Cross River Bank Cross River to reach even more small businesses in the PPP Second Draw Program. Cross River Bank is proud to serve as one of the top PPP lenders in the country reaching more than 375000 businesses.

Second QuickBooks Capital has teamed up with Cross River Bank a SBA-approved lender to facilitate PPP applications for a broader group of eligible QuickBooks customers directly through CRBs platform. While Kapitus sees healthy demand from its customer base for second-draw PPP loans Johnston says demand is not at the same level it was in April and May 2020 when there was even more economic uncertainty. Simple sole proprietor application no employees 4 docs needed.

These eligible customers will be able to apply for a second PPP loan up to 150000. I received my DocuSign documents from Cross River Bank for my second draw PPP loan early this morning. Due to funding no longer being available through the US Small Business Administration SBA Paycheck Protection Program PPP we are no longer accepting applications.

This company says it works both with Lendio an online lending marketplace and Cross River Bank to. Submitted application to Cross River Bank. See my current status from their portal here.

Second-Draw PPP Loan guide. Visit our FAQ page. I received my DocuSign documents from Cross River Bank for my second draw PPP loan early this morning.

I received a PPP first draw loan from Cross River Bank before the SBA changed the rule regarding how the loan amount is calculated.

Paycheck Protection Program Forgiveness Cross River Bank

Riverbank Protection Chapter 9 River Mechanics

Sba Paycheck Protection Loans Assistance Divvy

Riverbank Protection Chapter 9 River Mechanics

Cross River Bank Posts Facebook

What Happens If You Are Rejected For A Ppp Loan

Paycheck Protection Program Forgiveness Cross River Bank

Sba Paycheck Protection Loans Assistance Divvy

Riverbank Protection Chapter 9 River Mechanics

These Nonbank Lenders Are Accepting Round 2 Applications Forbes Advisor

Cross River Bank Paycheck Protection Program

Riverbank Protection Chapter 9 River Mechanics

Cross River Bank Paycheck Protection Program

Cross River Bank Posts Facebook

Cross River Bank Posts Facebook

Tm2026663 4 S1 None 70 196679s

Riverbank Protection Chapter 9 River Mechanics

Cross River Bank Paycheck Protection Program

These Nonbank Lenders Are Accepting Round 2 Applications Forbes Advisor